Geopolitical tensions between the United States and China could significantly impact global critical materials markets and supply chains under proposed trade policies from a potential second Trump presidency. Promises of at least 60% tariffs on Chinese goods raise particular concerns for critical mineral supplies, as approximately 80% of these supply chains currently run through China. China has already demonstrated its willingness to use critical materials as leverage, recently announcing export bans on gallium, germanium, antimony, and superhard materials to the United States. These restrictions target materials crucial for semiconductor production, defense applications, and electric vehicle manufacturing. According to a U.S. Geological Survey study, China's ban on gallium and germanium alone could reduce U.S. GDP by $3.4 billion.

The situation becomes more complex considering China's dominance in graphite production and processing, controlling 77% of natural graphite production and nearly all refining operations. The United States, currently 100% import-reliant with less than 15% of world graphite reserves, faces particular vulnerability to any expansion of Chinese export restrictions. The implications extend beyond just U.S.-China relations. Trump's stated willingness to reduce U.S. involvement in NATO could force European nations to accelerate their strategic planning for securing critical materials needed for military applications. This shift could lead to a more competitive and fragmented global resource market, with nations potentially hoarding resources or selling to the highest bidder.

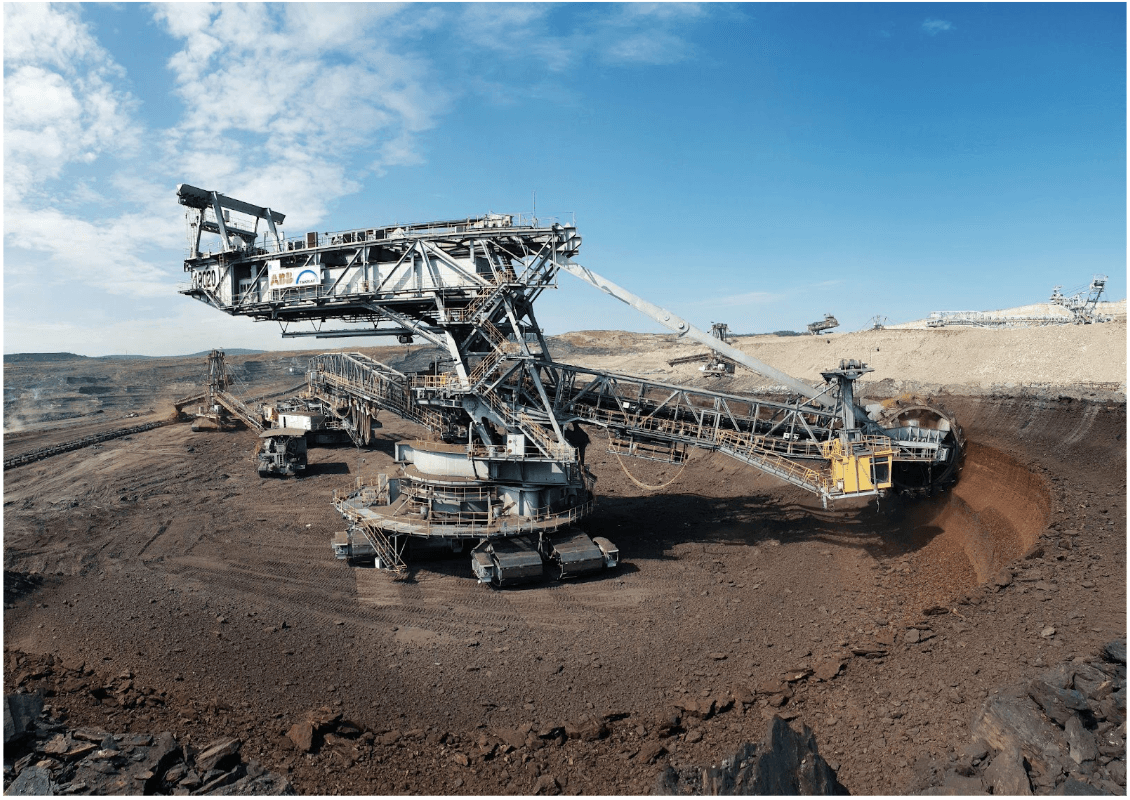

Several sectors stand to be significantly impacted by these developments. The semiconductor industry relies heavily on gallium for producing electronic components and high-powered chips. The defense sector depends on germanium for night vision goggles and infrared sensors, while antimony is crucial for armor-piercing ammunition and precision optics. The electric vehicle industry, which requires various critical minerals for battery production, could face particular challenges if China expands restrictions to include materials like lithium and copper. The potential reshaping of global supply chains under new trade policies could drive increased investment in domestic critical mineral production and processing capabilities. This shift might benefit companies involved in critical minerals mining and processing outside of China, as nations seek to secure their supply chains and reduce dependence on Chinese exports.

For industries dependent on these materials, the coming years may require significant adaptation to new supply chain realities and potentially higher costs for critical minerals. The situation highlights the strategic importance of developing diverse supply sources and the potential need for increased investment in critical mineral processing capabilities outside of China. The interplay between trade policies, geopolitical strategy, and resource security creates a complex landscape where nations must balance economic interests with strategic autonomy in critical materials essential for modern technology and defense systems.