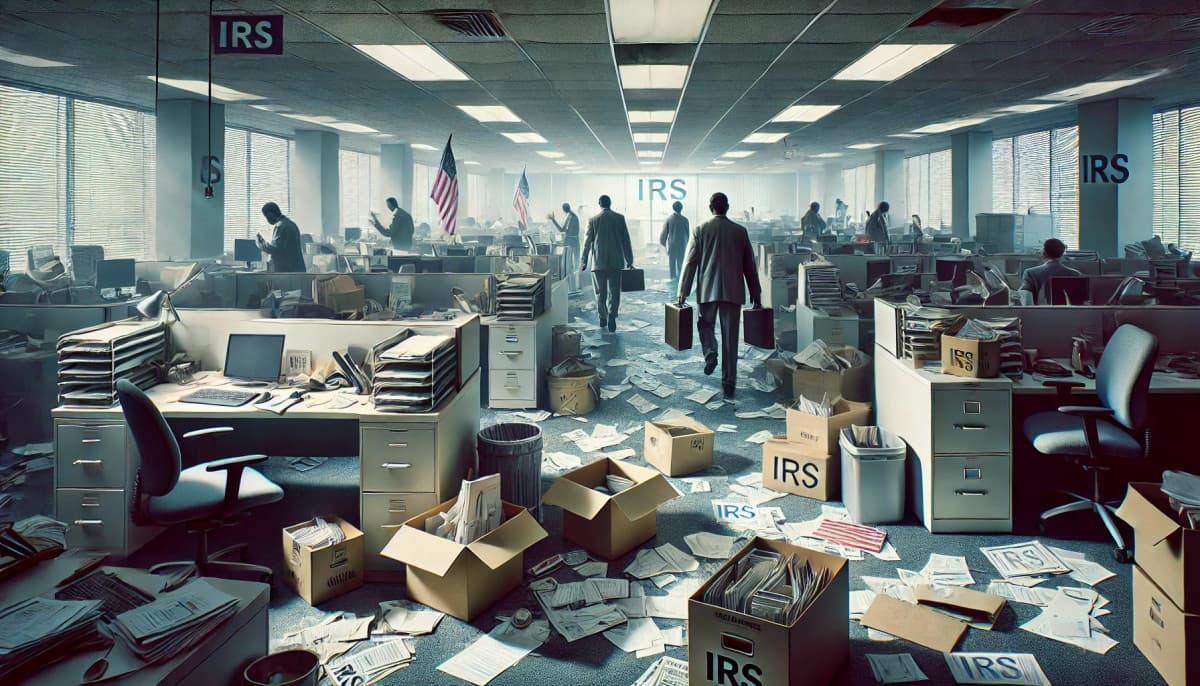

The Internal Revenue Service (IRS) is confronting substantial operational challenges following a workforce reduction of 6,000 employees, potentially creating significant disruptions for taxpayers during the upcoming tax season. The layoffs, stemming from federal workforce reductions initiated during the Trump administration, are expected to impact various critical aspects of tax administration, including return processing, refund distribution, and customer support. Taxpayers may experience prolonged wait times and delays in refund processing due to the diminished staff responsible for managing claims. These interruptions could create considerable financial strain for households that rely on timely tax refunds for budgeting and financial planning. The reduced workforce will likely exacerbate existing challenges in IRS customer service, making it increasingly difficult for individuals to obtain guidance and resolve tax-related inquiries.

Beyond return processing, the layoffs are anticipated to significantly affect tax audit procedures. With fewer auditors available, the IRS's capacity to conduct compliance checks and resolve tax discrepancies will be substantially compromised. This reduction could lead to extended processing times for audit notifications and limited resources for taxpayers navigating complex tax situations. The most critical areas expected to experience disruption include audit processing, compliance checks, and customer support. Taxpayers with pending tax debts or those requiring assistance with intricate tax matters may find themselves particularly vulnerable during this period of reduced IRS capacity.

Tax experts recommend that individuals proactively prepare for potential delays by maintaining meticulous financial records and seeking professional guidance when necessary. While the IRS workforce reduction presents significant challenges, understanding the potential impacts can help taxpayers develop strategic approaches to managing their tax responsibilities. The layoffs highlight broader conversations about government agency efficiency and the potential consequences of workforce reductions. As the tax season unfolds, the full extent of these operational changes will become increasingly apparent, potentially necessitating adaptations in how taxpayers approach their annual filing requirements.